Neluns – is an innovative financial ecosystem, combining within itself a bank, which operates with fiat and cryptocurrencies, a cryptocurrency exchange and insurance company, thus, creating conditions for the quality development of the cryptocurrency market and inflow of new participants and new capital.

- Limited amount of banking services.

- Limited selection of financial instruments.

- Difficulties with converting cryptocurrencies to fiat.

- Challenges in working with cryptocurrency exchanges:

- Exchanges crash during peak loads.

- Issues with registering and passing verification.

- Fund withdrawal limits.

- Big losses due to hackers attacks.

- A near full absence of cryptocurrencies being utilized as a means of payment.

- Absence of insuring trades and transactions.

Within the Neluns ecosystem, users will be able to:

- Purchase and sell cryptocurrencies in just a few clicks.

- Lead active cryptocurrency trading on the exchange.

- Deposit and withdraw funds from the system in just a few clicks from any part of the world.

- Open IBAN accounts – multicurrency personal and corporate accounts

- Release debit and credit Visa, MasterCard, and American Express cards

- Instantly send and receive international money transfers

- Store funds in Neluns deposits in fiat and cryptocurrencies earning interest

- Receive Neluns loans in fiat and cryptocurrencies

- Receive profits, from lending funds on a Peer-to-Peer (P2P) Lending Platform

- Insure any trades

- Gain profits from trading the NLS token on cryptocurrency exchanges

- Receive dividends

- Active market participants will be able to increase profits and lower risk levels

The emergence of Neluns will aid in the:

- Increased attractiveness of cryptoassets as investment objects

- Growth of cryptocurrency use as a means of payment

- Increase of cryptocurrency market participants

- Inflow of new capital to the cryptomarket

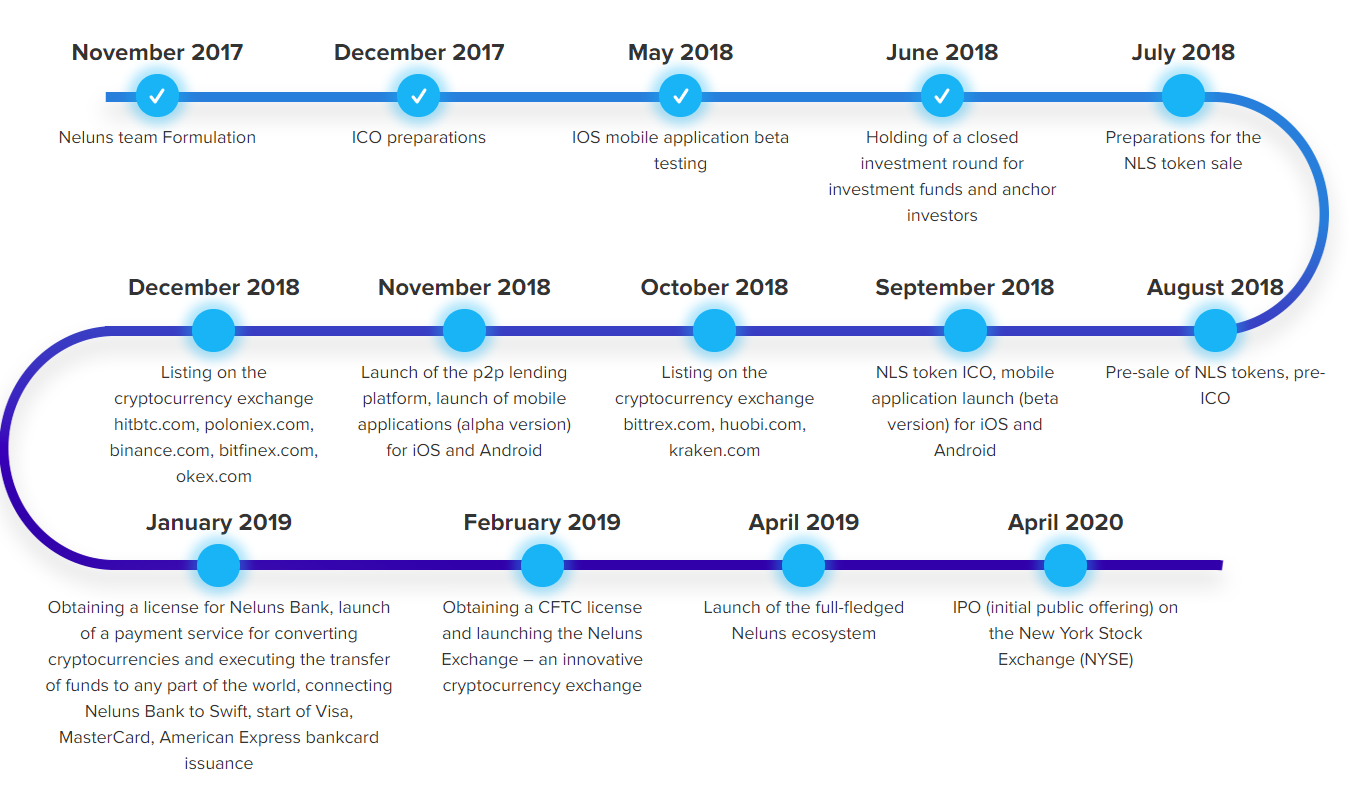

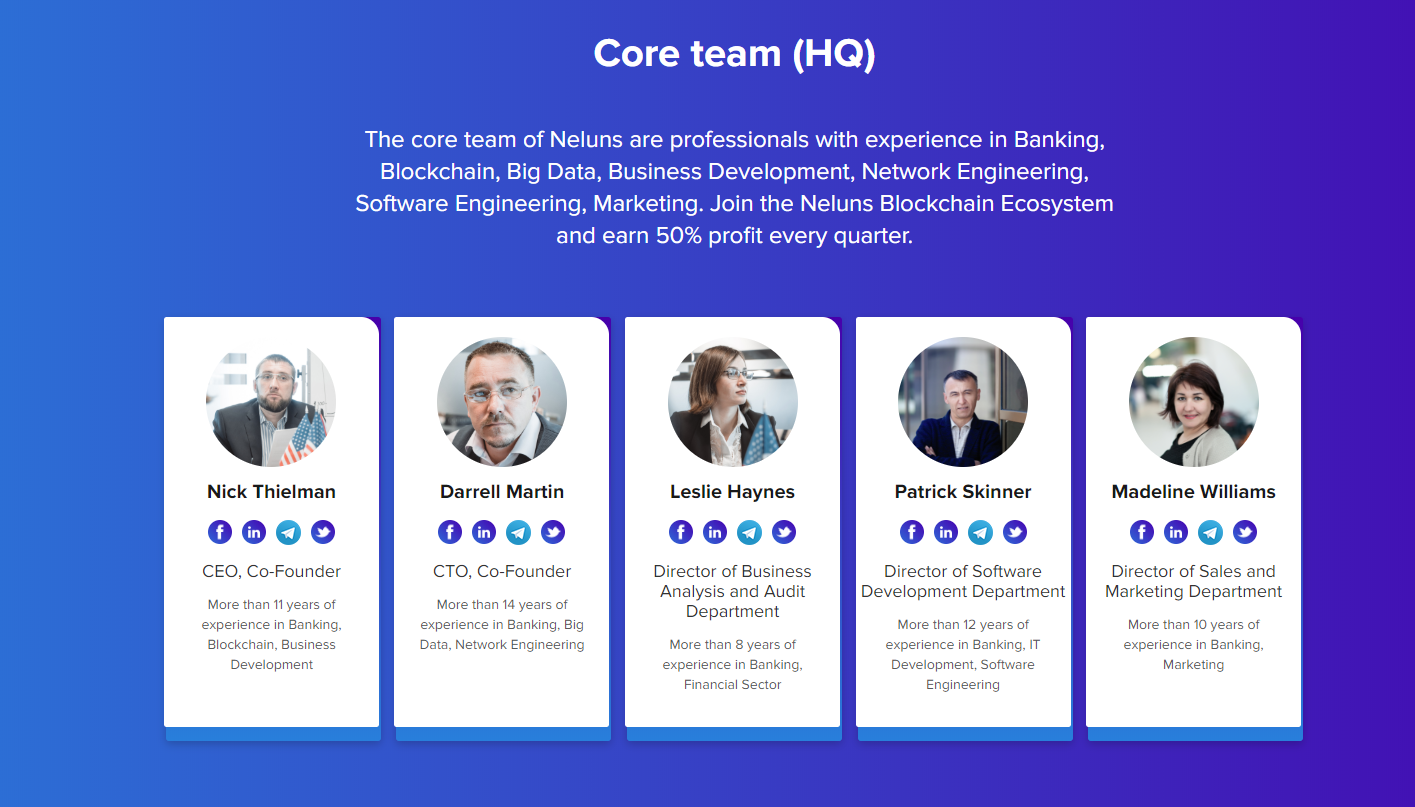

The Neluns team aims to minimize risks and build out the project in accordance with all legal norms. We are carrying out work on receiving a banking license. Neluns will comply with all FCA (Financial Conduct Authority) and PRD (Prudential Regulation Authority) requirements, which handle the issuance of licenses and bank activity oversight on the territory of the given country. The exchange and insurance company, Neluns, will also be registered in accordance with regulatory requirements.

NELUNS ECOSYSTEM FUNCTIONALITY

- 1-st level – email verification. Allows participating in trades on the Neluns Exchange (with 1:5 margin trading). Trade sums cannot exceed $300.

- 2-nd level – social network and mobile number verification.

- Allows participating in trades on the Neluns Exchange (with 1:10 margin trading) and the P2P lending platform. Trade sums cannot exceed $500.

- 3-rd level – identity and mobile number verification. Users gain access to all Neluns Bank services, Neluns Exchange (with 1:20 margin trading), Neluns Insurance. Restrictions on trade amounts are absent.

- Instant fund transfers, withdrawals and deposits at ATMs anywhere in the world.

- Debit and credit visa, Mastercard, American express card.

- Deposits in cryptocurrency and fiat.

- P2P Lending Platform

- Mobile app for iOS and Android.

- Buy and sell cryptocurrency in two clicks, exchange crypto for fiat.

- The principle of “bank guarantees”. Withdrawal of funds is easy, transaction speed is highest.

- Protection from cyber attacks

- Full functionality during peak load

- Effective user support services API and trade on the Nelun exchange through known software such as Fusion, TAKION, MetaTrader, Metastock, ROX, and others.

- Trade insurance

- Insurance transaction

- Protection from technical issues

- Protection from counterparty obligations that fail

SERVICES

BENEFITS OF WORKING WITH THE NELUNS SYSTEM:

- Users in the system get a wide range of benefits available to them. These are:

- Innovative technologies ensure a hassle-free and quick trading of cryptocurrencies despite the peak loads.

- Under the protection of the “Bank Guarantee” principle users can actively participate in trading of cryptocurrencies. “Bank Guarantee” principle in conjunction with leading technologies allows you to easy withdraw your funds. It also provides a high level of protection from cyber-attacks and creates perfect conditions for cryptocurrency traders and fiat funds. Users can make withdrawals from around the globe under the guard of the Federal Deposit Insurance Corporation (FDIC).

- Users get access to four types of debit or credit cards. These are: Lite, Silver, Gold, and Platinum.

- Users can access loans in fiat or cryptocurrency in the Neluns banking system.

- Gain profits while lending funds on a P2P (peer-2-peer) Lending platform. The lending platform will function at the base of Neluns Bank and authorized users will be able to use this service.

- Active users get higher protection and other additional benefits.

- Users can receive profits from trading NLS tokens and dividends from all insured trades.

- Users get a chance to open a private or corporate multicurrency IBAN account.

- Besides, making purchases, sending payments, trading cryptocurrencies and fund withdrawals are available from any ATM around the globe 24 hours 7 days a week. All users are able to carry out transactions in USD, EUR, GBR as well as cryptocurrencies. A bank card will automatically accompany the multicurrency IBAN account.

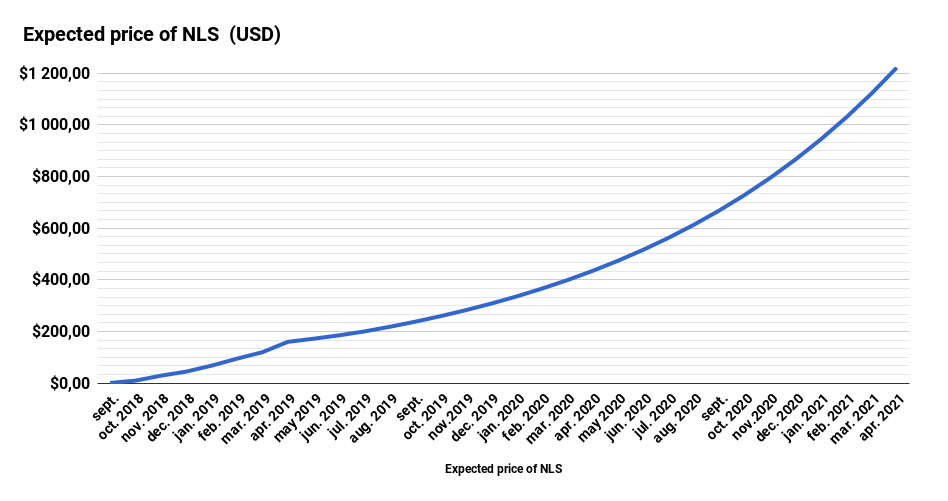

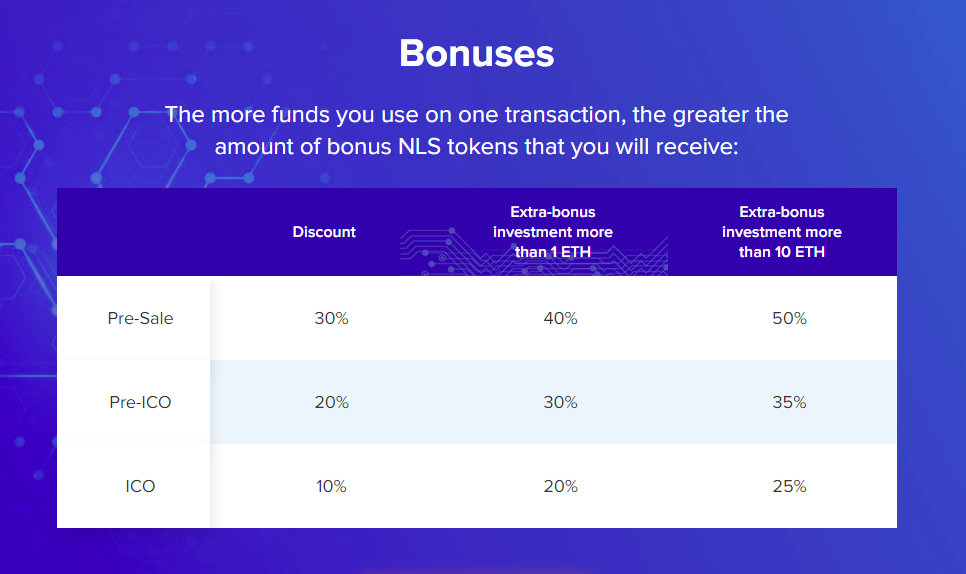

- During the ICO, 200 000 000 NLS tokens will be released

- Base price of 1 NLS token = 1 USD

- Token name : NLS

- Platform : Ethereum

- Standard : ERC-20

- Token amount : 200 000 000 NLS

- Hard Cap : 112 000 000 USD

- Base price of one token : 1 USD

Facebook: https://www.facebook.com/Neluns/

Twitter: https://twitter.com/theneluns

Telegram: https://t.me/TheNelunsChat

Medium: https://medium.com/@iconeluns

Whitepaper: https://neluns.io/static/ver165/whitepaper/whitepaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=4694028

Bouty Thread: https://bitcointalk.org/index.php?topic=4753775.0

Reddit: https://www.reddit.com/r/NelunsProject/?st=JK201PMO&sh=8e3addc0

Author : Amelia.lydia

Profil bitcointalk: https://bitcointalk.org/index.php?action=profile;u=2347774

Eth: 0xDDFA22800A7Ff4BEE1b6bac4FB5d3057318505D8